Happy Fall!

Over the past couple of years, the global economy’s been a lot like that Goldilocks story we all know, where the trick is to find the balance that’s “just right.” When things got going after the pandemic, the economy started heating up, kind of like the bowl of porridge that’s too hot. Folks were spending like crazy, and with supply chains struggling to keep up, prices shot up, giving us the inflation we’ve all been feeling. To cool things down, the Fed began to raise interest rates a couple years ago, trying to keep things from boiling over. They knew that if they pushed too hard and slowed the economy too much, we could end up with a cold bowl of porridge—things like higher unemployment and slower growth.

Last week the Fed began to cut interest rates, and they made their first trim by a substantial half a percent. Markets had been anticipating this first cut for some time and folks have decided that it is likely this Fed rate cut will be the first of many, with the approximate 5% rate we had been used to last month falling substantially over the balance of this year and next.

What we really want is that “just right” situation, where the economy’s humming along, not too fast, not too slow. So far, so good, we have had an economic situation that we think Goldilocks would have been pleased with and it just may be that we navigate this slowdown effort with a “soft landing” and a bowl of porridge that even an affronted bear would like. GDP growth was around 3% last quarter, and inflation has moderated significantly during the year, way down from the punishing rate of over nine percent in mid-2022.

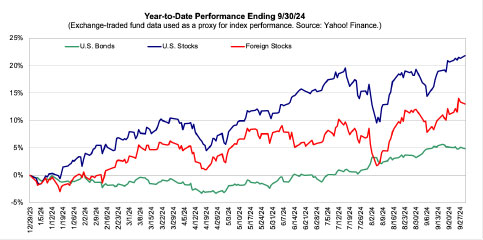

Markets closed this last quarter as if the soft landing was a done deal. Stocks, both domestic and foreign, continued their cheerful rise, albeit with several weeks of backing and filling during the quarter as they reacted to specific events along the way. The participation of individual market sectors began to broaden this last quarter as the large tech leaders of earlier in the year paused their headlong rise while other sectors took their place. Value stocks gained considerable ground, moving ahead of growth segments during this broadening.

We have been especially pleased with the substantial rebound this year of real estate securities, even in the face of continuing bad news from the office space segment. Only a small part of the real estate exposure in your portfolio is involved in office space with lots of exposure to other parts of the REIT (Real Estate Investment Trust) universe such as warehouses, data centers, cell towers and others. While the whole REIT sector was punished by the pandemic situation of office vacancies the reality was that much of actual investment was in other commercial real estate areas which were doing quite well. Patient investors (such as yourselves) were rewarded as market participants came to their senses and realized the value inherent in this area.

Real estate securities, due to their higher yields, are also interest rate sensitive and so the prospect of lower rates provides a tailwind here as well.

Bonds too have benefitted from the prospect of falling interest rates. Remember the bond teeter-totter, bond prices rise when interest rates decline. This was a good quarter for all sorts of bonds as the notion of rates falling pushed bond values up. With the economy mostly on a good footing there aren’t any substantive credit quality concerns to spoil the show.

In the displayed charts, the following exchange-traded fund data has been used as a proxy for index performance. "U.S. Bonds" by iShares Core U.S. Aggregate Bond ETF (Ticker: AGG). "U.S. Stocks" by SPDR S&P 500 ETF (Ticker: SPY). "Foreign Stocks" by iShares MSCI EAFE ETF (Ticker: EFA). Source: Yahoo! Finance, FocusPoint Solutions calculations.

Of course, just because it seems like smooth sailing now doesn’t mean there might not be storms just over the horizon. Geopolitical concerns have grown with the situation in the Middle East, raising the possibility of a region-wide conflict. The war in Ukraine continues, with its attendant worries about stability in that region. Apart from the horrific humanitarian impact, both situations could adversely affect inflation, energy costs, and maritime trade.

The inflection point we find ourselves in regarding monetary policy brings its own set of concerns. Should the Fed find itself on the wrong side of policy decisions we could find ourselves suddenly on the defensive. While we don’t think this a likely scenario it is certainly something to bear in mind and those concerns may bring market volatility depending on how markets view the data as it rolls in over the balance of the year.

As we discussed in our last letter, we don’t think the upcoming elections will cause longer term volatility issues. No matter the outcome, life will go on and, despite the claims of each campaign promising doom if the other side wins, we’re cognizant that the economy will find a way to muddle through regardless of the outcome.

We think that diversification and attention paid to asset class valuation levels will continue to pay handsome dividends of reduced volatility and returns commensurate with portfolio design. We make sure to keep your nest egg spread across the different baskets of asset class types and our discipline of changing portfolio composition based on relative asset class valuations continues to be fundamental to client success.

We appreciate your trust and wish you a happy fall and holiday season.

Sincerely,